Nov-1 to Nov-8

Happy Friday,

Green hydrogen is breaking ground in California, and ocean-based carbon tech is redefining carbon capture solutions. Cement’s surprising potential to aid climate efforts is making waves in industrial decarbonization, while Maryland’s tech scene shows how local initiatives can tackle climate change. High-profile solar IPOs are energizing the market, and cleantech accelerators are giving startups a boost. The EPA’s $3B investment in port sustainability could shift infrastructure investment trends, and Virginia’s emerging startup landscape hints at a new hub for innovation. From sustainable ventures leading the charge to the $7.5 trillion roadmap needed for net-zero, clean tech is pushing boundaries and attracting big investment moves.

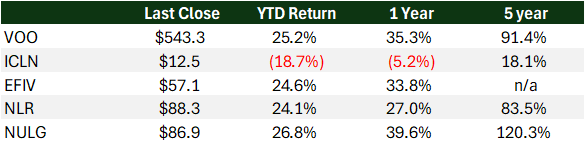

- VOO – S&P 500 Index, representing 500 of the largest U.S. companies

- ICLN – This ETF tracks companies involved in clean energy production, such as wind, solar, and other renewables, with global exposure

- EFIV – This ETF tracks companies in the S&P 500 index that meet certain environmental, social, and governance (ESG) criteria

- NLR – This ETF provides exposure to companies involved in nuclear energy production, including those involved in uranium mining and nuclear power plant construction and maintenance

- NULG – Focuses on large-cap U.S. companies with superior ESG ratings

Headline Roundup

Climate Tech & Sustainability

- Where to build your climate tech startup: Goldman’s $75 trillion green tech roadmap (FXS)

- Climate tech crucial in transitioning away from fossil fuels (EM)

- How ecotourism promote the protection of the environment and its positive impact? (TB)

- Top 10: Sustainable Companies in Energy (EM)

- Cement could save the planet (FC)

- Addressing the Tech Industry’s Carbon Footprint in Silicon Valley (TB)

Clean & Alternative Energy

- US Election 2024: Pivotal Moment for Green Energy Policy (EM)

- Avina breaks ground on ‘green hydrogen’ facility in Southern California (PVM)

- How Maryland’s Tech Companies Are Tackling Climate Change (TB)

Investments & Startups

- Sustainable Ventures: Behind the World’s Leading Startups (EM)

- The Future of Startups in Virginia’s Tech Scene (TB)

- ACME Solar IPO: Price Band, Key Dates, Financials, Risks, GMP — All You Need To Know (NDTV)

- US Environmental Protection Agency announces $3-bn investment in ports (F2F)

- Startup stumbles upon potential solution to mitigate major global pollutant (TCD)

- Five Climate Tech Startups to Watch in 2024 (OGP)

- UChicago Cleantech Accelerator Resurgence Accepts 5 Startups into its Second Cohort (PLSK)

The Breakdown

Investor Insights: The clean tech sector is surging with investments in green hydrogen, carbon removal, and sustainable materials. Avina’s green hydrogen facility and BrineWorks’ ocean-based carbon tech signal growth in alternative fuels. Maryland’s climate tech and major solar IPOs like ACME show rising investment interest, while cleantech accelerators (e.g., UChicago’s) support emissions-focused startups. The EPA’s $3B port sustainability funding could spark further infrastructure investments. However, with Goldman’s $7.5 trillion climate tech roadmap underscoring vast capital needs, strategic navigation is key in this evolving, opportunity-rich market.

TLDR: The clean tech space is witnessing notable growth and innovation. Here’s what’s happening:

- Green Hydrogen and Carbon Tech: Avina’s new green hydrogen facility and BrineWorks’ ocean-based carbon capture innovations are leading growth in alternative energy sources.

- Sustainable Industry Solutions: Cement’s potential for climate impact and Maryland’s climate tech initiatives highlight new decarbonization avenues.

- Renewable Investment: Solar IPOs, such as ACME, reflect increased public interest in renewable energy investments.

- Cleantech Startups and Funding: Programs like UChicago’s accelerator are fostering early-stage ventures focused on emissions and efficiency.

- Infrastructure and Policy: The EPA’s $3B port sustainability funding points to more infrastructure investments, while Goldman’s $7.5 trillion roadmap underscores the massive capital required for net-zero goals.

These insights showcase an evolving sector filled with opportunities, though challenges related to scale, funding, and policy will play crucial roles in shaping future momentum.