Nov-29 to Dec-6

Happy Friday,

Hydrogen is taking the spotlight with Panasonic’s major bet on green production, while subterranean hydrogen exploration races toward unlocking limitless clean energy. Carbon removal startups are raking in funding, with Heirloom’s $150M round leading the way and Everest Carbon pioneering enhanced weathering solutions. Fusion energy milestones are drawing investor confidence, signaling the rise of a new era in clean power. Solar energy startups like Glow are shining with $30M funding boosts, and U.S. clean energy growth hits record highs. Amazon’s AI-powered carbon capture and loyalty tech startup Rediem’s $12M pre-seed show how innovation is merging with sustainability. From carbon to fusion, startups are scaling fast and funding is flowing, making this a defining moment for clean tech.

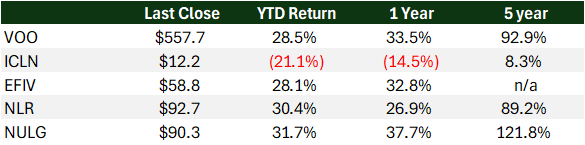

*As of Market Close 12/05/2024

- VOO – S&P 500 Index, representing 500 of the largest U.S. companies

- ICLN – This ETF tracks companies involved in clean energy production, such as wind, solar, and other renewables, with global exposure

- EFIV – This ETF tracks companies in the S&P 500 index that meet certain environmental, social, and governance (ESG) criteria

- NLR – This ETF provides exposure to companies involved in nuclear energy production, including those involved in uranium mining and nuclear power plant construction and maintenance

- NULG – Focuses on large-cap U.S. companies with superior ESG ratings

Headline Roundup

Climate Tech & Sustainability

- Panasonic Bets Big On Green Hydrogen At Hi-Tech Welsh Factory (FORB)

- The global shipping industry is on a path to net zero (TG)

- Amazon AI data centers could double as carbon capture machines (SMFR)

Clean & Alternative Energy

- Sunrise brief: A record third quarter for U.S. clean energy (PVM)

- Top 9 Solar Energy Trends to Watch in 2025 & Beyond (SUI)

- Fusion Energy Milestone: A Bold Step Toward Clean Power (ER)

- Global Race to Unlock Subterranean Hydrogen: The Future of Limitless Clean Energy (SCITD)

Investments & Startups

- Loyalty platform startup rediem announces $1.2 million pre-seed round headed up by Ivy Ventures (RTIH)

- Energy & Sustainability M&A Activity — December 2024 (NLR)

- Meet two early-stage climate startups scaling breakthrough technologies (SFTD)

- Wells Fargo awards $250,000 to three startups (KLRS)

- Sensor startup raises $3M for monitoring carbon removal (AXIOS)

- 8 MIT sustainability startups to watch (MIT)

- Heirloom raises $150M for its limestone-based carbon removal tech (CM)

- Solar energy startup Glow raises $30 million from Framework, Union Square (ETIME)

The Breakdown

Investor Insights: The clean tech sector is advancing rapidly with key innovations and investments shaping the future of sustainable energy. Panasonic’s investment in green hydrogen at its Welsh factory highlights the growing demand for hydrogen as a cornerstone of the clean energy transition. Meanwhile, subterranean hydrogen exploration is gaining traction as a potential game-changer for limitless, clean energy.

Record-breaking clean energy growth in the U.S., coupled with solar startup Glow’s $30 million funding, underscores strong investor confidence in renewables. Carbon removal remains a focal point, with Heirloom raising $150 million for its limestone-based carbon capture technology and Everest Carbon advancing enhanced rock weathering. Fusion energy milestones also signal growing feasibility for long-term clean power solutions.

Amazon’s AI-driven carbon capture and M&A activity in sustainability reveal an increasing integration of technology and finance into decarbonization efforts. Investors should monitor scaling breakthroughs in hydrogen, carbon removal, and fusion, while leveraging opportunities in renewables and sustainable M&A. However, navigating funding competition and regulatory dynamics will be critical for maximizing returns in this evolving space.

TLDR: The clean tech industry is thriving with breakthroughs in energy production, carbon capture, and renewables. Major trends include:

- Hydrogen Innovations: Panasonic’s green hydrogen investment and the race for subterranean hydrogen showcase the growing potential of hydrogen as a clean energy solution.

- Carbon Removal Advances: Heirloom’s $150M for limestone-based capture and Everest Carbon’s rock weathering tech highlight progress in scalable carbon removal.

- Fusion Energy Milestones: Recent advancements signal increased viability for fusion as a long-term clean power source, attracting significant investment.

- Solar and Clean Energy Growth: A record-setting quarter for U.S. clean energy and Glow’s $30M solar funding underscore strong market confidence in renewables.

- Tech-Driven Decarbonization: Amazon’s AI-powered carbon capture and sustainability M&A activity reflect a deeper integration of technology into decarbonization efforts.

These developments illustrate a clean tech sector poised for transformative growth, with emerging opportunities in hydrogen, carbon solutions, and fusion energy. Strategic focus will be essential to navigate competition and scaling challenges.