Oct-25 to Nov-1

Happy Friday,

Carbon capture is stepping up with ocean-based tech and innovative CO2-to-liquid fuel methods, while AI’s power needs might actually boost climate efforts. Small modular reactors are redefining energy for data centers, and hydrogen-electric planes are taking off with new funding. Floating wind technology backed by big names like Bill Gates is making waves, and Boston’s green tech scene is buzzing with fresh ideas. The drive toward net-zero targets demands trillions, putting the spotlight on investments in renewables, nuclear, and emissions-slashing startups. With breakthroughs in clean tech and sustainability, the future is looking bold and investor-ready.

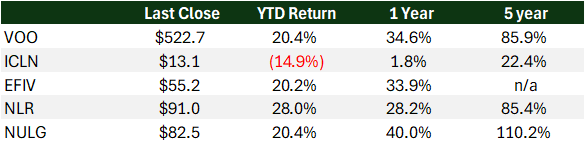

- VOO – S&P 500 Index, representing 500 of the largest U.S. companies

- ICLN – This ETF tracks companies involved in clean energy production, such as wind, solar, and other renewables, with global exposure

- EFIV – This ETF tracks companies in the S&P 500 index that meet certain environmental, social, and governance (ESG) criteria

- NLR – This ETF provides exposure to companies involved in nuclear energy production, including those involved in uranium mining and nuclear power plant construction and maintenance

- NULG – Focuses on large-cap U.S. companies with superior ESG ratings

Headline Roundup

Climate Tech & Sustainability

- Capturing carbon from the air just got easier (UCB)

- Microsoft clinches ocean-based carbon removal deal with Ebb Carbon (ESGD)

- This small startup’s new tech is slashing home heat, hot water, and AC costs: ‘It’s cutting our bills by 42% (YHOO)

- WoodMac: $3.5 Trillion Needed Annually to Hit Net Zero Targets (HE)

- The importance of sustainability (ELP)

- Filling in the Blanks on Kamala Harris’ Climate Agenda (FP)

- Green Tech Innovations Emerging from Boston (TB)

Clean & Alternative Energy

- A look at the energy companies Bill Gates is backing (QRTZ)

- AI Power Demand Might Actually Turn Out to Be Good for Climate (EC)

- SpiralWave’s pulsing plasma towers transform carbon dioxide into liquid fuel (TC)

- Deep Atomic Launches Small Modular Reactor to Power the Future of Data Centers (EEL)

- Top 10: Solar Energy Projects (EM)

- How Has LEGO Doubled its Renewable Energy Capacity? (EM)

- How the U.S. Energy Department Reorganized to Champion Clean Energy (TIME)

- Exploring Technology’s Role in Efficiency and Sustainability (EM)

Investments & Startups

- Morgan Stanley Strikes Deal With Climeworks to Vacuum CO2 From the Atmosphere (INC)

- Measurable Energy Secures £4 Million Investment to Accelerate Global Growth (SQ)

- Carbon Ridge Raises $9.5 Million to Advance Maritime Shipping Decarbonization Technology (ESGT)

- Startup shakes up industry with revolutionary wind turbine design backed by Bill Gates — here’s what it’s capable of (TCD)

- Startup Beyond Aero Raises $20 Million for Its Hydrogen-Electric Private Jets (WSJ)

- A new nuclear fusion startup has raised $900M in Series A funding (PE)

The Breakdown

Investor Insights: The clean tech landscape is evolving rapidly, driven by advancements in carbon capture, modular nuclear reactors, and floating wind technology. Significant investments, such as Microsoft’s ocean-based carbon removal credits and Morgan Stanley’s partnership with Climeworks, highlight a growing focus on scalable carbon reduction solutions. While modular nuclear startups, like Deep Atomic, are securing funding to power data centers, Bill Gates-backed ventures in wave and floating wind tech reflect a push toward decentralized renewable energy sources.

Emerging trends include innovative hydrogen-electric applications, evidenced by Beyond Aero’s $20M funding for private jets, and AI’s growing energy demand, which, counterintuitively, may drive more sustainable tech adoption. Investors should monitor this intersection of AI, nuclear, and renewable innovations as potential game changers for decentralized energy grids. However, with global net-zero targets requiring an estimated $3.5 trillion in annual investments, navigating capital allocation amidst potential regulatory and economic shifts remains crucial.

TLDR: The clean energy sector is advancing with significant innovation and investment. Key trends include:

- Carbon Capture and Removal: Investments in ocean-based carbon removal and partnerships for CO2 capture (e.g., Microsoft, Climeworks) underscore the growing focus on scalable carbon solutions.

- Nuclear and Renewables: Modular nuclear reactors for data centers and Bill Gates-backed floating wind technology signal a shift toward decentralized and reliable clean power.

- AI’s Energy Role: AI’s rising power demand may spur sustainable tech adoption, positioning AI as both a challenge and opportunity for clean energy.

- Hydrogen and Aviation: Hydrogen-electric tech is gaining traction, with Beyond Aero securing funding for green aviation solutions.

- Investment Needs: Achieving global net-zero targets requires substantial investment, with estimates of $3.5 trillion annually. Regulatory and economic variables could impact progress.

These developments show the intersection of tech and sustainability, presenting investment opportunities alongside policy and funding challenges.