Oct-18 to Oct-25

Happy Friday,

Nuclear power is setting sail with revolutionary ship tech, while AI and big tech are turning to nuclear energy to cut carbon. Wave energy is riding high with major investments, and hydrogen fuel is gaining new traction. Former coal towns are going green with low-carbon cement, and grid-enhancing technologies are reshaping energy infrastructure. As cleantech heats up, the fusion of innovation and investment is sparking big moves in sustainability, even as questions about a potential bubble loom.

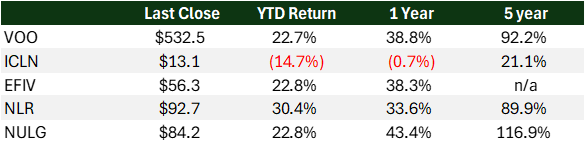

- VOO – S&P 500 Index, representing 500 of the largest U.S. companies

- ICLN – This ETF tracks companies involved in clean energy production, such as wind, solar, and other renewables, with global exposure

- EFIV – This ETF tracks companies in the S&P 500 index that meet certain environmental, social, and governance (ESG) criteria

- NLR – This ETF provides exposure to companies involved in nuclear energy production, including those involved in uranium mining and nuclear power plant construction and maintenance

- NULG – Focuses on large-cap U.S. companies with superior ESG ratings

Headline Roundup

Climate Tech & Sustainability

- The Role of Virginia in Promoting Sustainable Technology Solutions (TB)

- World’s First Nuclear Ship With Revolutionary Sail Technology Begins Sea Trials (MI)

- Liquid solvent direct air capture’s cost and carbon dioxide removal vary with ambient environmental conditions (SN)

- A former Utah coal town could soon become a hub for low-carbon cement (CM)

Clean & Alternative Energy

- Google Signs First Nuclear Energy Deal to Address Growing AI Carbon Footprint (ESGT)

- Swedish Firm Lines Up $35M Investment in Its Wave Energy Tech (OE)

- Amazon Addresses Energy Demands with Nuclear Energy Projects (EM)

- ASDA’s Bio-LNG Revolution Fuels Greener Future (EM)

- How Extreme H is Changing Hydrogen Fuel Perceptions (EM)

Investments & Startups

- Department of Energy Funds Five More Grid Enhancing Technologies Projects (CE)

- Retailers Are The Surprising Leader Among U.S. Industries For Green Investments (FBS)

- Is the cleantech bubble about to burst? Findings from Europe’s largest cleantech event (TFN)

- Matteco Raises €15 Million To Expand Production Of Advanced Materials For Green Hydrogen (REM)

- Caelum Ventures raising $150M for climate and defense fund (AP)

- 16 energy software startups to watch, according to investors (SFT)

- 4 Areas Where Seed Funding Is Strong, From AI Assistants To Carbon Capturers (CB)

- A look at the energy companies OpenAI’s Sam Altman is backing (YHO)

The Breakdown

Investor Insights: Recent advancements in nuclear energy, hydrogen fuel, and grid-enhancing technologies are creating exciting investment opportunities in clean energy. Google and Amazon’s nuclear energy deals signal growing interest from tech giants, while $35M raised for wave energy and shifts in hydrogen fuel perception highlight growing investor confidence in alternative energy sources. However, concerns about a potential cleantech bubble and the evolving policy landscape require careful navigation. Investors should focus on startups driving AI-driven carbon reduction, nuclear energy, and grid innovation, as these sectors could reshape future energy infrastructure.

TLDR: Clean energy and sustainability sectors are gaining momentum with significant investments and innovations. Key trends include:

- Nuclear and AI: Google and Amazon are embracing nuclear energy to power their data centers and reduce carbon footprints, signaling growing tech interest in sustainable energy.

- Wave and Hydrogen Tech: A $35M investment in wave energy and shifts in hydrogen fuel tech are driving interest in alternative energy solutions.

- Grid Enhancements: The U.S. Department of Energy’s funding for grid-enhancing technologies is paving the way for more efficient, resilient energy infrastructure.

- Low-Carbon Materials: Former coal towns, like in Utah, are becoming hubs for low-carbon innovations, such as cement, pointing to opportunities in transforming legacy industries.

- Cleantech Bubble Concerns: Despite increasing funding, there are worries about a potential cleantech bubble, and evolving policies could introduce uncertainty.

These trends illustrate the growing integration of technology and sustainability, offering promising investment opportunities amidst potential policy and market challenges.

Recourses